Navigating Philadelphia's 2025 Real Estate Market: A Guide for First-Time Homebuyers

Philadelphia's real estate market is heating up, and for first-time homebuyers, this is an exciting yet challenging time to enter the market. Recently ranked fifth on Zillow’s list of the hottest U.S. markets for 2025, the city offers opportunities for growth and homeownership, provided you navigate its complexities with the right information and strategy. Here’s what you need to know to succeed as a first-time buyer in Philadelphia this year.

Understanding the 2025 Philadelphia Real Estate Landscape

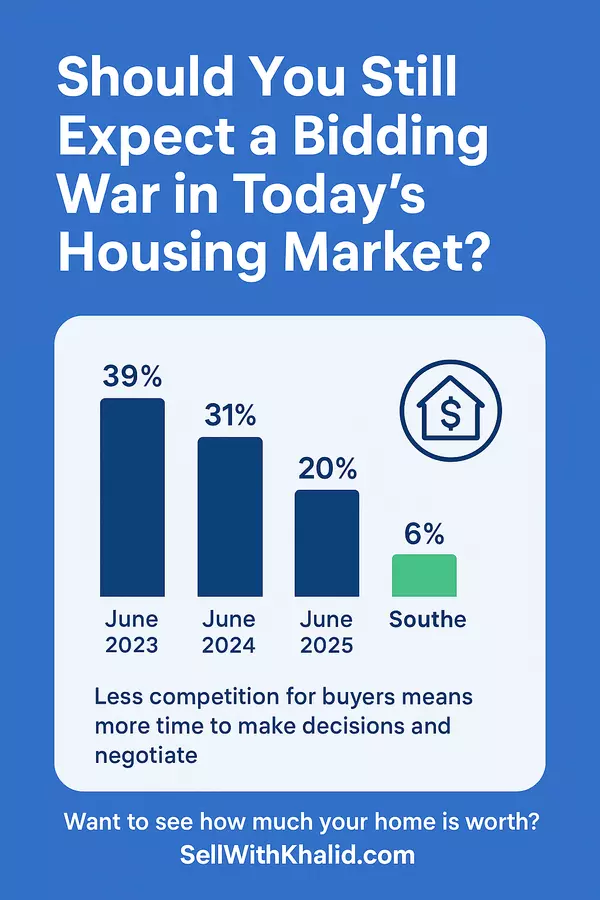

The real estate market in Philadelphia has seen steady growth, with home values projected to increase by 3% to 4% this year. This upward trend is fueled by high demand and limited inventory, which means homes are selling faster and often above asking prices. For first-time buyers, this competitive environment requires preparation, strategy, and quick decision-making.

Despite the competition, Philadelphia remains a relatively affordable metro compared to nearby cities like New York and Washington, D.C. This affordability, coupled with a range of financial assistance programs, makes it an ideal time for first-time buyers to make their move.

Key Considerations for First-Time Homebuyers

1. Affordability and Budgeting

Philadelphia offers a mix of price points, but affordability depends on careful financial planning. First-time buyers should:

- Assess their overall budget, including down payments, monthly mortgage payments, property taxes, and maintenance costs.

- Consider additional expenses such as HOA fees (if applicable) and insurance.

- Explore loan options like FHA loans, which are popular among first-time buyers due to their lower down payment requirements.

2. Mortgage Rates

Current mortgage rates are averaging around 6.91%, which can impact how much you can afford. Understanding these rates and how they affect monthly payments is essential. Shop around for the best rates and consider locking in rates early if the market indicates potential increases.

3. Neighborhood Selection

Philadelphia’s diversity shines in its neighborhoods, offering a wide range of options for first-time buyers. Some neighborhoods to consider:

- Fishtown: A trendy area with a mix of modern developments and historic charm, ideal for young professionals and families.

- South Philadelphia: Known for its tight-knit communities, great food scene, and affordability.

- West Philadelphia: A growing hub for families, with spacious homes and proximity to parks and universities.

Research local amenities, schools, and community vibes to find a neighborhood that aligns with your lifestyle and long-term goals.

Leveraging Down Payment Assistance Programs

One of the biggest challenges for first-time buyers is saving for a down payment, but Philadelphia offers robust programs to help.

Philly First Home Program

This program provides a grant of up to $10,000 or 6% of the home’s purchase price (whichever is lower) to help with down payment and closing costs. To qualify, buyers must complete a city-funded homeownership counseling program before signing an agreement of sale.

First Front Door Program

This program offers grants to help with down payment and closing costs. It’s available on a first-come, first-served basis, so buyers should act quickly when funding opens annually.

Local Nonprofits and Banks

Many local nonprofits and banks in Philadelphia and Delaware County also offer programs tailored for first-time buyers. Check with housing organizations or consult a real estate agent specializing in first-time buyers to discover additional resources.

Steps to a Successful Home Purchase

To increase your chances of a smooth and successful homebuying experience, follow these steps:

1. Participate in Homeownership Counseling

Homeownership counseling prepares you for the responsibilities of owning a home. Topics include:

- Budgeting for homeownership.

- Understanding credit scores and how to improve them.

- The step-by-step process of buying a home.

Not only is this often a requirement for assistance programs, but it also equips you with the tools to make informed decisions.

2. Get Pre-Approved for a Mortgage

Securing a mortgage pre-approval is a critical first step. It shows sellers that you’re a serious buyer and gives you clarity on what you can afford. Work with a lender to determine your eligibility for special loans like FHA or VA loans.

3. Partner with a Knowledgeable Real Estate Agent

Working with an agent who specializes in Philadelphia’s real estate market can make all the difference. They can help you:

- Identify properties that fit your criteria and budget.

- Navigate the negotiation process.

- Understand the nuances of the local market, such as typical closing costs or seller concessions.

The Competitive Edge: Timing and Strategy

In a fast-paced market like Philadelphia, timing is everything. Homes can sell within days of being listed, especially in sought-after neighborhoods. Here’s how to stay ahead:

- Be Flexible: Be open to visiting homes as soon as they hit the market.

- Make Competitive Offers: In a hot market, lowball offers are unlikely to succeed. Work with your agent to make a strong yet reasonable bid.

- Prepare for Bidding Wars: Be prepared to act quickly and decisively in multiple-offer scenarios.

Conclusion

Entering Philadelphia's real estate market as a first-time homebuyer in 2025 presents both opportunities and challenges. By understanding the current market dynamics, leveraging available assistance programs, and following a structured approach, you can confidently navigate the process and make informed decisions toward achieving homeownership.

Ready to take the next step? Whether you’re looking to buy your first home, upgrade, or downsize, I’m here to guide you every step of the way. Contact me today to start your journey toward finding your dream home in the Philadelphia Metro area or Delaware County.

📞 Call/Text: 267-930-1249

📧 Email: Khalid@RealEstateBul.com

🌐 Visit: www.SellWithKhalid.com

Let’s make your real estate goals a reality! 🏡

Categories

Recent Posts